Implications of Fed’s New Policy

Key Takeaways

- The Fed recently changed its inflation-targeting stance, a move that may appear trivial but could have significant implications for investors.

- This new policy means that the Fed will likely hold off on raising short-term interest rates allowing the economy to grow at a stronger pace.

In late August, Federal Reserve (Fed) Chair Jerome Powell announced a new policy framework for managing inflation known as “average inflation targeting.” This move came as the Fed has already implemented several policy measures to limit the damage from COVID-19 lockdown and maintain financial stability. For investors, this move might seem trivial but could have significant implications and is worthy of a deeper discussion.

What is different about this?

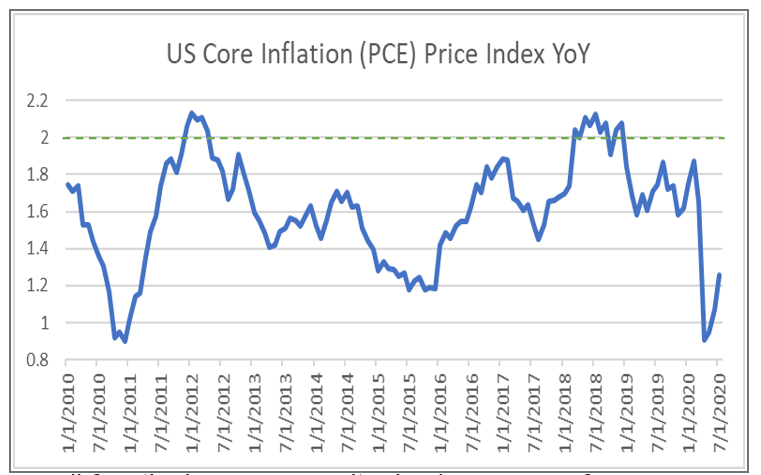

The Fed has two mandates: maximum employment and price stability. Maintaining price stability, that is avoiding high inflation rates or deflation (falling prices), is important because fluctuating prices can distort economic growth and make it difficult to evaluate how to align montetary policies such as setting interest rates. Previously, the Fed’s definition of price stability was to aim for 2% inflation as measured by Personal Consumption Expenditures price index (PCE). In the new version, the Fed believes that if inflation averages below 2% for long periods, as it has for the past ten years, then it would allow inflation to run well above 2% to achieve the 2% target, on average. The Fed has not provided a precise formula on what would define the average, thus providing them adequate wiggle room to target average inflation in a flexible way.

Why the shift in stance on inflation?

Since the great financial crisis, the Fed implemented unprecedented policies by slashing interest rates and buying bonds and other assets known as quantitative easing. These actions spurred a decade-long expansion and historic low unemployment prior to the COVID-19 crisis. Despite achieving the goals of economic growth and maximum employment, inflation has remained below target.

This breaks with a classic theory that the Fed has relied on called the Philips Curve – an economic theory that lower levels of unemployment contribute to higher wages and, in turn, higher inflation. Thus with the recent changes, the Fed acknowledged that while price stability is important for a well-functioning economy, it raised concerns of persistently low inflation being a drag on economic growth. The Fed’s goal is that the average inflation target will make it easier to fight economic downturns.

How does this impact investors?

There are three key takeaways for investors. First, this new policy means that the Fed will likely hold off on raising short-term interest rates until prices rise above the target inflation of 2%. This is a deviation from the past when it raised interest rates during 2018 and 2019 as inflation reached the 2% target. Keeping interest rates low for a longer period will allow the economy to grow at a stronger pace than usual and allow the unemployment rate to fall to very low levels. A low interest-rate environment has historically been positive for risk assets like equities. Second, debtholders will benefit. Continued low interest rates help those who may currently hold a mortgage or a car loan to refinance higher interest loans to lower payments, freeing up money for additional consumption. Finally, inflation could become a concern down the road. Investors concerned about longer-term inflation should consider incorporating inflation protection within portfolios for the long run.

Do you have questions?

Reach out to us. We are happy to review your question(s) with you. We can be reached at (510) 200-8655 or at support@definedplanning.com

[1] https://www.federalreserve.gov/faqs/what-economic-goals-does-federal-reserve-seek-to-achieve-through-monetary-policy.htm

[2] https://www.chicagofed.org/research/dual-mandate/dual-mandate

[3] https://www.stlouisfed.org/open-vault/2020/january/what-is-phillips-curve-why-flattened

IMPORTANT INFORMATION

This report is for informational purposes only, is not a solicitation, and should not be considered investment, legal or tax advice. The information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed, and is subject to change. Investors seeking more information should contact their financial advisor.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. AssetMark and third-party service providers are separate and unaffiliated companies. Each party is responsible for their own content and services.

©2020 AssetMark, Inc. All rights reserved.

101140 | C20-16617 | 09/2020 | EXP 09/30/2021

AssetMark, Inc.

1655 Grant Street

10th Floor

Concord, CA 94520-2445

800-664-5345